Supplier invoice management

Reconcile, check, validate: your invoices in complete security.

- OCR and automatic invoice integration.

- 3-way reconciliation with orders and receipts.

- Native compliance with the 2026/2027 e-bill reform.

Why digitize supplier invoice management?

The supplier invoice is the final but also the most critical step in the purchasing process. Without the right solution, financial services suffer:

time-consuming manual entries,

disputes related to price or quantity discrepancies,

a risk of non-compliance with the e-invoicing reform.

With Weproc, your invoices are centralized, automated and linked to your orders. You gain in efficiency, security and regulatory compliance.

Case in point: a mid-sized company was processing 500 invoices per month manually. With Weproc, OCR extracts data, 3-way automatically checks 70% of invoices without intervention, and only disputed invoices are reviewed manually.

How it works Invoice management with Weproc?

Automatic capture and integration

Import manually or via dedicated mailbox.

Direct association with the purchase order.

3-way controls and reconciliation

Automatic verification of prices, quantities, conditions.

Comparison with order and receipt.

Blocking in the event of a deviation, until regularization.

E-bill validation and compliance

Configurable validation workflow.

Ready for the French reform:

Acceptance mandatory from September 2026,

Progressive issuance (GE/ETI 2026, SME/micro 2027).

Features features related to Bills

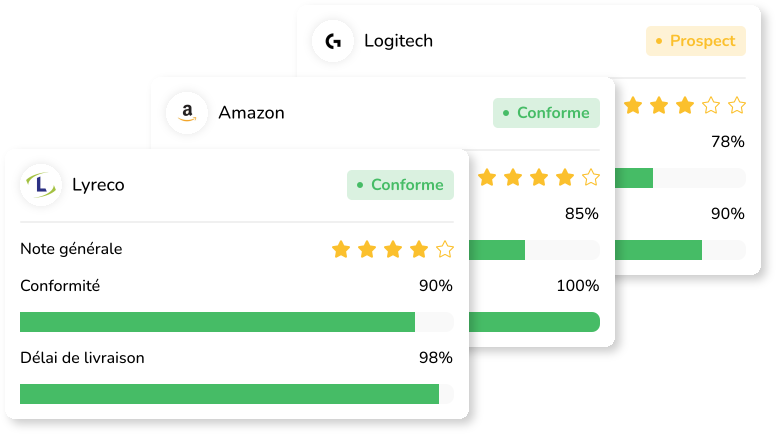

SRM – supplier management that powers your supply chain

Centralize all your supplier files in a single space to gain visibility and compliance; Drive performance with real-time metrics and detailed reporting. A collaborative portal simplifies exchanges: order tracking, invoices and administrative documents, all without scattered emails. A secure digital vault houses attestations, contracts, and certifications for a stress-free audit, while predictive dashboards detect risks early.

The icing on the cake: Weproc connects natively to your ERP and accounting software for always up-to-date data. The result: strengthened supplier relationships, controlled costs and a resilient supply chain.

CONTRATS

Sécurisez chaque accord et boostez vos économies

Numérisez l’ensemble de vos accords-cadres et contrats fournisseurs dans un coffre-fort cloud, accessible en un clic. Weproc suit pour vous tout le cycle de vie contractuel : alertes avant reconduction tacite, échéanciers d’indexation, suivi de la consommation réelle et calcul automatique des remises de fin d’année. Une vue globale, filtrable par fournisseur ou famille d’achat, révèle les risques de rupture et les opportunités d’économies. Relié nativement à vos modules Budgets et SRM, le gestionnaire de contrats transforme la conformité en avantage compétitif et garantit un approvisionnement sans faille.

WORKFLOWS

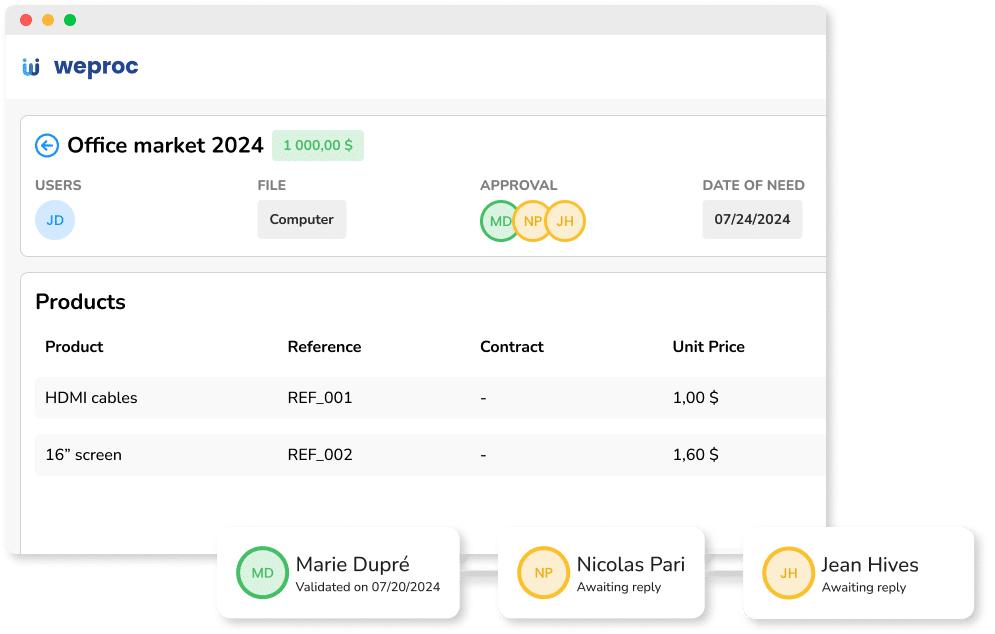

Standardisez vos validations, sécurisez vos engagements

Standardisez vos validations en un clin d’œil : Weproc modélise votre matrice d’approbation (montant, catégorie, projet, fournisseur, centre de coûts) et oriente automatiquement chaque demande vers le bon décideur. Configurez des niveaux d’approbation séquentiels ou parallèles, des règles de délégation (remplaçants, congés), des seuils et exceptions (urgence, contrat-cadre). Les managers valident en 1 clic sur web ou mobile ; des relances intelligentes et escalades réduisent les temps morts. Un journal d’audit complet assure traçabilité et conformité, tandis que des tableaux de bord mettent en évidence goulots d’étranglement et temps de cycle pour optimiser vos processus. Directement connecté aux modules Demandes, Commandes, Factures et Budgets, le workflow déclenche contrôles et alertes au bon moment. Résultat : décisions plus rapides, engagements maîtrisés, contrôle interne renforcé.

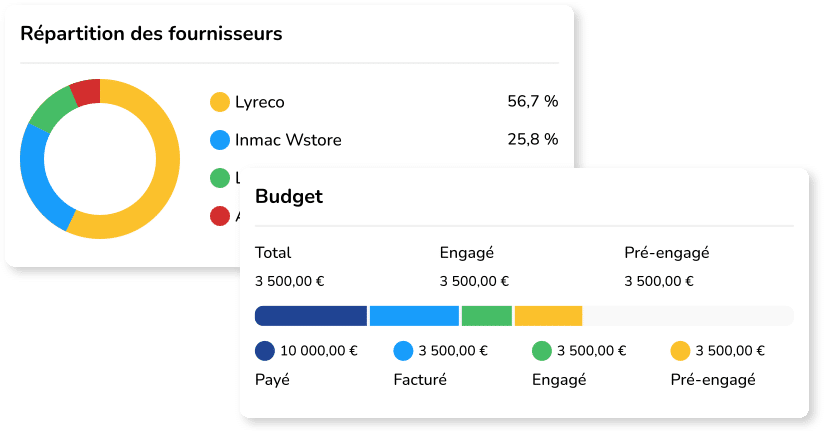

STATISTICS – Manage your purchases with smart dashboards

Align every purchasing decision with reality: Weproc converts your data feeds into interactive, ready-to-use dashboards . Instantly see the breakdown of expenses by vendor, category, or project and detect discrepancies before they weigh on your margin. The datasets are already cleaned; export them in one click to Excel, Power BI or in your monthly reports to save valuable time. Thanks to its real-time indicators and proactive alerts, the Statistics module transforms simple observation into quick action: you secure your budgets, strengthen your negotiations and manage supplier performance to the nearest cent.

Up to 80% faster processing time compared to manual entry.

Discover the full range of features

The strategic levers of Invoice management in 2026

To transform supplier invoice management into a competitive advantage, four levers are essential:

Automate data entry : thanks to advanced OCR, key data from your invoices is extracted with 98.5% accuracy, regardless of their format (PDF, scan, Factur-X, EDI, etc.).

Secure payments : 3-way reconciliation (order-receipt-invoice) automatically blocks disputed invoices and ensures that only posted amounts are paid.

Ensure compliance: Weproc is natively compliant with the 2026 e-invoicing reform, with legal archiving and compliance with the GDPR.

Manage cash flow : dashboards, alerts and advanced reporting give you real-time visibility into your deadlines and financial commitments.

With Weproc, invoice management is not limited to a simple administrative control: it becomes a lever for financial performance, by connecting your purchases to your accounting and securing your P2P flows.

FAQ – Purchasing software for supplier invoices

Are you thinking of digitizing your purchases? Find here the answers to the most common questions asked in the case of the digitization of supplier invoices.

What does supplier invoice management in purchasing software consist of?

It is the digitization of the entire invoice cycle: reception/capture → controls → reconciliation → validation (BAP) → accounting → archiving integration. Linked to orders and receipts, it eliminates re-entry and secures your payments. In Weproc, the invoice becomes a “reconciled” object (price, quantities, VAT, analytics) with full traceability for audit and closing.

How does OCR work in Weproc and what invoice formats are supported?

Advanced OCR automatically extracts key fields (supplier, invoice number, dates, lines, VAT, IBAN, etc.) with a high recognition rate (≈ 98.5%). Invoices come in via dedicated email, manual filing or ERP/EDI integration. Weproc handles PDF/scan and structured formats (Factur-X, UBL, CII, EDI). Anti-duplication and consistency control mechanisms (totals, VAT, currencies) make the data reliable upstream.

How does the "3-way" reconciliation and exception handling work?

The engine compares order ↔ receipt ↔ invoice : if everything matches, the invoice goes to STP processing (without intervention). In the event of a discrepancy, Weproc applies configurable tolerances , isolates the anomaly (price/quantity/fees) and blocks the payment until resolved. Non-PO cases (services, subscriptions) move to 2-way with enhanced approval workflow . Also covered: partial receipts, multi-PO invoices, multi-line invoices and credit notes.

How does Weproc help me to be compliant with the 2026/2027 electronic invoicing?

Weproc supports structured formats (e.g. Factur-X) and archiving with probative value, with audit log and GDPR compliance. The solution supports you in 4 areas:

-

Diagnosis of current flows,

-

Data & format mapping ,

-

Workflow/control settings ,

-

Change Management (training + testing).

Prepare for mandatory reception (2026) and progressive issuance (Large/Mid-sized Enterprises in 2026, SMEs/Micro-businesses in 2027).

Which accounting/ERP integrations and data are synchronized?

Weproc integrates bi-directionally (API/exports) with 50+ ERP and accounting software. Synchronized: third-party vendors, plans/dimensions, cost centers, budgets (PDPs), entries (including NPF), payment statuses, and documents. The result: zero double entries, clean entries and pre-accounting ready for closing.

How are validation, internal control and compliance managed?

Validation is based on configurable workflows (thresholds, services, amounts, exceptions) with segregation of duties (creation ≠ approval ≠ payment). Each action is time-stamped (audit log), the documents are legally archived and access is secure (rights, SSO possible). Legal payment deadlines are monitored via alerts and dashboards.

Do you manage complex cases: assets, recurrences, multi-entity and multi-currency?

Yes.

-

Credit Notes : Matching to Original Invoice, Partial/Total Balances.

-

Recurring invoices/subscriptions : templates + periodic checks.

-

Multi-entity / multi-site : rules, charts of accounts and budgets by entity with consolidated vision.

-

Multi-currency / multi-VAT : VAT rates, currencies and schemes managed by country, with harmonized reporting.

What KPIs should you track to measure invoice management performance?

The main indicators are:

-

STP rate : The share of invoices processed automatically without intervention.

-

Processing time : time between receipt and validation (BAP).

-

Exception rate : Invoices blocked for discrepancies or disputes.

-

Cost per invoice : a key indicator of ROI.

-

Compliance with payment deadlines : to avoid penalties and preserve supplier relations.

With Weproc, you track these KPIs in real-time through visual dashboards and smart alerts, allowing you to improve productivity, optimize your cash flow, and objectify supplier performance.

Purchasing procedures complementary to the Bills

Consultations

Invite your suppliers, receive and compare offers on a single platform. Ensure transparency and competitiveness thanks to the multi-criteria comparison tool and the traceability of decisions.

Commands

Generate your purchase orders in one click from a validated request or a consultation. Track statuses and deadlines to ensure the reliability of your supplier commitments.

Payment

Track your deadlines, control your legal deadlines and secure payments. Weproc helps you avoid disputes and optimize your cash flow.