Supplier payment management

Prepare, validate and secure your payments with ease.

- Automatic generation of SEPA files.

- Bidirectional synchronization with your accounting tool.

- Dashboards to control your deadlines and your cash flow.

Why digitize supplier payment management?

Supplier payment is the final step in the P2P process. Too often, it still relies on manual exports, fragmented validations and re-entry errors, which leads to late payments, supplier disputes and a lack of visibility into the cash flow.

With Weproc, your payments are automated, centralized and linked to your validated invoices. You respect the legal deadlines, avoid mistakes and keep total control of your financial flows.

Case in point: a mid-sized company manages 2,000 supplier payments per month. Thanks to Weproc, the generation of SEPA files is automatic, statuses are synchronized with the ERP, and delays have been reduced by 65%.

How it works Payment management with Weproc?

Payment generation and transmission

Automatic creation of SEPA files from validated invoices.

Secure transmission to your bank.

Possible blocking of the disputed payments.

Accounting monitoring and integration

Two-way synchronization with more than 50 ERPs and accounting software.

Automatic import of validated invoices.

Real-time update of payment statuses (paid, pending, rejected).

Control of deadlines and cash flow

Customizable dashboards to track your deadlines.

Smart alerts to anticipate delays.

Consolidated cash projection, by site or entity.

Features

keys

related to

Payments

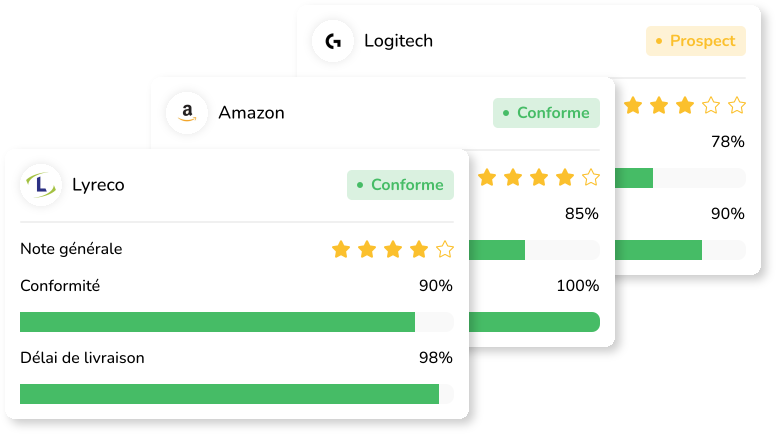

SRM – supplier management that powers your supply chain

Centralize all your supplier files in a single space to gain visibility and compliance; Drive performance with real-time metrics and detailed reporting. A collaborative portal simplifies exchanges: order tracking, invoices and administrative documents, all without scattered emails. A secure digital vault houses attestations, contracts, and certifications for a stress-free audit, while predictive dashboards detect risks early.

The icing on the cake: Weproc connects natively to your ERP and accounting software for always up-to-date data. The result: strengthened supplier relationships, controlled costs and a resilient supply chain.

CONTRATS

Sécurisez chaque accord et boostez vos économies

Numérisez l’ensemble de vos accords-cadres et contrats fournisseurs dans un coffre-fort cloud, accessible en un clic. Weproc suit pour vous tout le cycle de vie contractuel : alertes avant reconduction tacite, échéanciers d’indexation, suivi de la consommation réelle et calcul automatique des remises de fin d’année. Une vue globale, filtrable par fournisseur ou famille d’achat, révèle les risques de rupture et les opportunités d’économies. Relié nativement à vos modules Budgets et SRM, le gestionnaire de contrats transforme la conformité en avantage compétitif et garantit un approvisionnement sans faille.

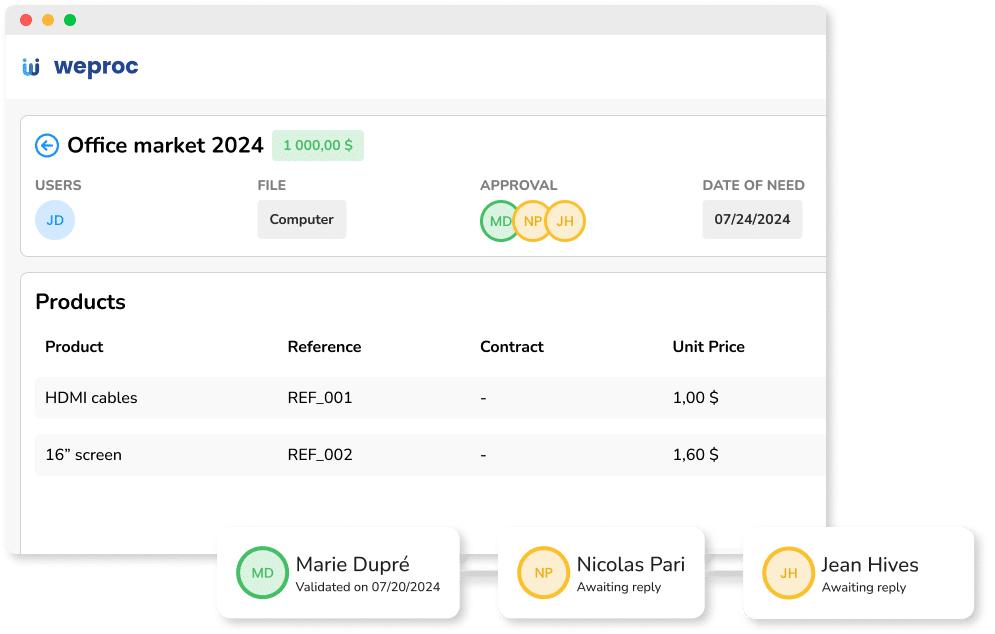

WORKFLOWS

Standardisez vos validations, sécurisez vos engagements

Standardisez vos validations en un clin d’œil : Weproc modélise votre matrice d’approbation (montant, catégorie, projet, fournisseur, centre de coûts) et oriente automatiquement chaque demande vers le bon décideur. Configurez des niveaux d’approbation séquentiels ou parallèles, des règles de délégation (remplaçants, congés), des seuils et exceptions (urgence, contrat-cadre). Les managers valident en 1 clic sur web ou mobile ; des relances intelligentes et escalades réduisent les temps morts. Un journal d’audit complet assure traçabilité et conformité, tandis que des tableaux de bord mettent en évidence goulots d’étranglement et temps de cycle pour optimiser vos processus. Directement connecté aux modules Demandes, Commandes, Factures et Budgets, le workflow déclenche contrôles et alertes au bon moment. Résultat : décisions plus rapides, engagements maîtrisés, contrôle interne renforcé.

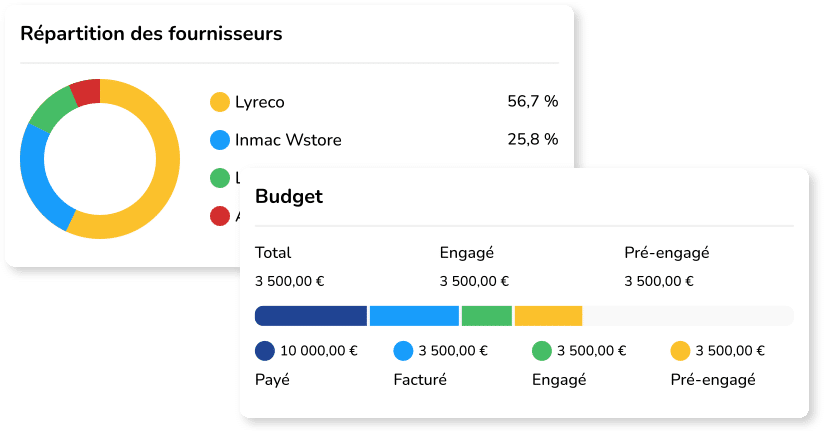

STATISTICS – Manage your purchases with smart dashboards

Align every purchasing decision with reality: Weproc converts your data feeds into interactive, ready-to-use dashboards . Instantly see the breakdown of expenses by vendor, category, or project and detect discrepancies before they weigh on your margin. The datasets are already cleaned; export them in one click to Excel, Power BI or in your monthly reports to save valuable time. Thanks to its real-time indicators and proactive alerts, the Statistics module transforms simple observation into quick action: you secure your budgets, strengthen your negotiations and manage supplier performance to the nearest cent.

-50% time spent preparing payments.

Discover all our features

The strategic levers of Payment management in 2026

To make supplier payment management a strategic asset, four levers are essential:

Automate payments : Generate your SEPA files with one click and securely transmit them to your bank.

Synchronize with accounting : statuses (paid, pending, rejected) are updated automatically from your ERP, without double entry.

Control cash flow : dashboards and smart alerts allow you to anticipate your deadlines and optimize your financial flows.

Guarantee compliance : compliance with legal payment deadlines (LME), complete traceability of validations and archiving with probative value.

With Weproc, payment management goes beyond simple bank execution: it becomes a strategic building block of financial management, directly linked to your validated invoices, your budgets and your cash flow.

FAQ – Purchasing software for Payments

Are you thinking of digitizing your purchases? Find here the answers to the most common questions asked in the case of the digitization of supplier payments.

What is supplier payment management in procurement software?

It is the centralization and automation of payments from validated invoices (BAP): selection of deadlines, generation of the SEPA file, secure sending to the bank, then monitoring of the status (paid, pending, rejected). Connected to your ERP/accounting, Weproc eliminates re-entry, applies your approval rules and guarantees complete traceability of validations.

How does the generation of a SEPA payment file with Weproc work?

From the list of “good to pay” invoices, you:

-

filter by due date, supplier, entity, currency,

-

Apply approval workflows (thresholds/amounts)

-

generate the compliant SEPA file in one click,

-

Send the file to the bank.

Weproc performs automatic checks (IBAN present, duplicates, amount, currency) and keeps the acknowledgment for the audit.

Does the "paid" status automatically go up from my accounting tool?

Yes. Two-way integration updates the status of payments (paid, rejected, partial) directly from your ERP/accounting software. Reconciliations are enriched with the bank reference and the actual date of execution, which offers a reliable view of commitments vs. disbursements without double entry.

How does Weproc help me meet the legal payment deadlines (LME) and avoid penalties?

-

Dashboards by D-7 / D-/ delay,

-

Smart alerts to approvers and finance,

-

Automatic blocks for disputed invoices (3-way discrepancies) to avoid undue payments,

-

Time-stamped action history to justify your deadlines in the event of an audit.

The result: higher payment rate at maturity , lower penalties and disputes.

What KPIs should I track to measure the performance and ROI of payments?

Track: payment rate at maturity, DPO (Days Payable Outstanding), cost per payment, rejection rate, SEPA vs manual volume, discounts obtained, penalties avoided. Weproc’s dashboards and alerts help you accelerate cycles, secure flows and objectify financial performance.

Can I manage multiple companies, locations, and currencies in payments?

Yes. Weproc is multi-company / multi-site / multi-currency :

-

bank accounts by entity,

-

Approval rules and dedicated payment schedules,

-

consolidated views for treasury arbitration,

-

Support for currencies with consolidated origin amounts and equivalents.

How to monitor payment deadlines and anticipate cash flow?

In Weproc, all invoices that have been validated and are ready to be paid appear with their due date. You can view upcoming payments at a glance (by week or month) and receive alerts to avoid delays. This information, synchronized with your accounting, gives you better visibility on your disbursements and facilitates your financial arbitrations.

What happens if a payment is not executed as expected?

Once the SEPA file has been generated and transmitted, the status of the payments is updated automatically via the integration with your ERP or accounting tool. If a payment remains pending or is rejected on the accounting side, the information is reflected in Weproc, allowing you to monitor the situation and follow up if necessary. This way, your teams always have a reliable and consolidated view of supplier payments.

Purchasing procedures

complementary to the

Payments

Purchase Requests

Centralize the expression of needs through intelligent forms and a configurable workflow. Real-time budget monitoring with the PDP for fast and error-free validations.

Commands

Generate your purchase orders in one click from a validated request or a consultation. Track statuses and deadlines to ensure the reliability of your supplier commitments.

Billings

Automate data entry with OCR, reconcile orders and receipts, prepare your payment vouchers. Complies with the Factur-X 2026/2027 reform.